Understanding the Basics of Secured and Unsecured Loans

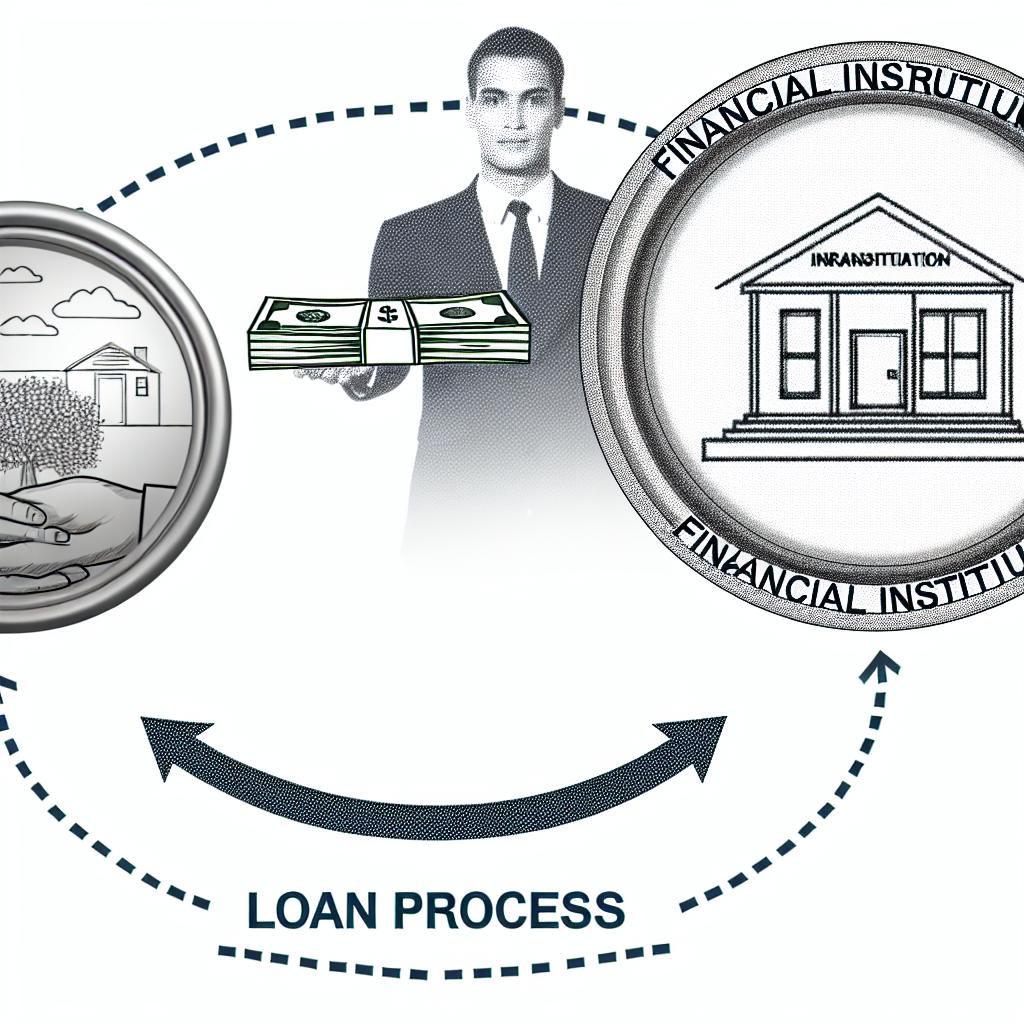

When borrowing money, you will often encounter two primary types of loans: secured loans and unsecured loans. Each has its own features, benefits, and risks. Understanding these differences is crucial for making informed financial decisions.

Secured Loans

A secured loan is a type of loan that requires the borrower to offer collateral, which is an asset that can be seized by the lender if the borrower fails to repay the loan. Common types of secured loans include mortgages and auto loans.

Collateral Requirement

In secured loans, collateral can range from properties and vehicles to other valuable assets. The presence of collateral typically makes secured loans less risky for lenders, often resulting in lower interest rates compared to unsecured loans. By having this safety net, lenders are more willing to offer favorable terms to borrowers.

Pros and Cons

Advantages:

- Lower Interest Rates: Because the presence of collateral reduces the risk for lenders, they often offer lower interest rates compared to those available with unsecured loans.

- Potentially Larger Loan Amounts: With the security provided by collateral, lenders may be more willing to approve larger loan amounts.

- Longer Repayment Terms: Secured loans can come with longer repayment periods, providing more flexibility in managing payments over time.

Disadvantages:

- Risk of Losing the Asset: If borrowers default on their payments, the collateral—whether it be a home, car, or other valuable property—can be seized by the lender.

- May Require Complex Paperwork and Evaluations: The process of securing the loan with collateral may require appraisals and additional documentation, which can be time-consuming.

Unsecured Loans

Unsecured loans do not involve any collateral. Instead, lenders offer them based on the borrower’s creditworthiness. Common examples include personal loans and credit cards.

Creditworthiness

Without the security of collateral, lenders primarily consider the borrower’s credit score and financial history to assess risk. A high credit score and a solid financial history indicate to lenders that the borrower is capable of repaying the loan. This usually results in higher interest rates as compared to secured loans and may limit the loan amounts available.

Pros and Cons

Advantages:

- No Risk of Losing Personal Assets: Since unsecured loans do not require collateral, borrowers do not risk losing a personal asset in case of default.

- Faster Approval Times: The absence of collateral means less paperwork and typically faster approval processes, making unsecured loans a quicker option for those in need of immediate funds.

Disadvantages:

- Higher Interest Rates: Due to the increased risk for the lender, unsecured loans often come with higher interest rates compared to secured loans.

- Stricter Eligibility Criteria: Lenders may require a higher credit score and excellent financial history before approving an unsecured loan, which may be a hurdle for some borrowers.

Choosing Between Secured and Unsecured Loans

The decision between secured and unsecured loans depends largely on individual circumstances. It’s important to consider several factors to make the most appropriate choice for your financial situation.

Factors to Consider

When deciding between a secured or unsecured loan, consider the intended use of the loan. For example, if you’re purchasing a house or a car, a secured loan might align more closely with your needs due to the associated asset serving as collateral. However, for smaller, personal expenses or debt consolidation, an unsecured loan could be more convenient.

Your current financial stability is another crucial factor. Secured loans may be more accessible if you have reliable assets and are comfortable with them being used as collateral. Conversely, if your situation doesn’t allow for asset risk or if you’re seeking a quicker financial solution, an unsecured loan may be preferable.

Understanding your comfort with risks is essential as well. Evaluate how the potential of losing a pledged asset impacts your decision. If safeguarding your assets is a priority, unsecured loans might seem more attractive despite their higher interest rates.

Availability of Loan Options

Different lenders offer diverse loan products. It’s advantageous to shop around, comparing interest rates, terms, and conditions from various financial institutions. For more information on making an informed decision, you can visit financial advisory resources like Bankrate or NerdWallet.

Secured Loans: A Better Option When

Secured loans might be a better option if you have a valuable asset and are looking for lower interest rates. They can enable larger borrowing amounts with manageable repayment schedules, especially when financing significant purchases like homes or vehicles.

Unsecured Loans: A Better Option When

Conversely, unsecured loans could be more suitable if you prefer not to risk your assets or need faster access to funds. They are typically used for personal expenses, smaller purchases, or when you don’t have significant assets to pledge as collateral.

Final Thoughts

Always ensure to review the terms and conditions thoroughly before committing to any loan agreement. It’s advisable to consult with financial advisors or use online resources to strengthen your understanding of the loan products available. Careful consideration of your needs and an understanding of the benefits and drawbacks associated with each type of loan will empower you to make a financially sound decision. Remember, choosing the right loan type goes a long way in minimizing financial risk and optimizing your available resources.