Understanding Loans

A loan is a financial instrument that involves the lending of money by one or more individuals, organizations, or financial institutions to other individuals, organizations, or institutions. The borrower incurs a debt and is obligated to repay the lender according to the agreed terms, which usually include the payment of principal and interest. Loans are fundamental components of modern finance and are integral in facilitating various aspects of economic activity.

Types of Loans

Loans can take many forms, catering to the diverse needs and circumstances of borrowers. Among the most common types are:

Personal Loans: These are typically unsecured loans, used for personal expenses such as home renovations, medical bills, or vacations. Personal loans are often available through banks, credit unions, and other lending institutions. Due to their unsecured nature, they may attract higher interest rates to compensate for the increased risk to the lender.

Mortgage Loans: Secured by real estate property, these loans are used to purchase residential or commercial properties. They often feature long repayment terms and are structured with fixed or variable interest rates. The property itself serves as collateral, reducing the lender’s risk and often resulting in lower interest rates compared to unsecured loans. Mortgages are typically associated with significant sums that demand serious financial planning.

Auto Loans: Specifically intended for the purchase of vehicles, these loans are often secured against the automobile itself. Lenders may offer attractive terms to incentivize borrowing for car purchases. Auto loans usually have shorter terms than mortgage loans, often ranging from three to seven years. The lender retains the title of the vehicle as collateral until the loan is fully repaid.

Student Loans: Designed to finance education-related expenses, these loans can be provided by the government or private lenders. Student loans often feature unique repayment terms and interest rates. For instance, government-backed student loans usually offer lower interest rates and more flexible repayment options compared to private student loans. They can be either subsidized or unsubsidized, affecting how interest accumulates over time.

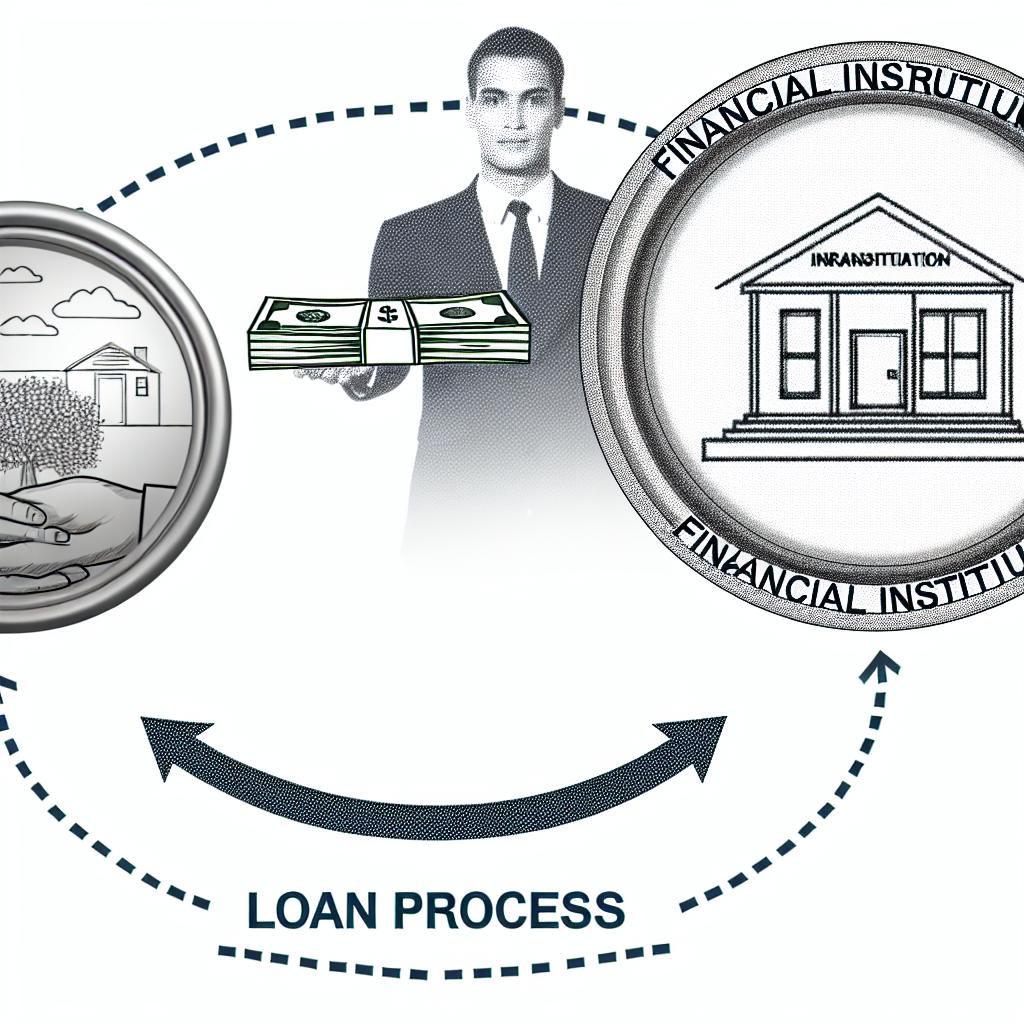

How Loans Work

The process of obtaining a loan generally follows a structured set of steps, each essential for ensuring that both the lender and borrower have a clear understanding of their obligations and rights.

Application

The borrower begins by submitting a loan application, providing necessary information such as the desired loan amount, purpose, income, credit history, and employment status. This information is crucial as it allows the lender to assess the borrower’s creditworthiness. The borrower’s credit score, a numerical representation of their credit history, plays a significant role in determining loan eligibility and terms.

Approval

Upon reviewing the application and conducting a credit check, the lender decides whether to approve or deny the loan. Approval is based on factors like the borrower’s credit score, income stability, and debt-to-income ratio. The lender evaluates the risk of lending funds and determines whether the borrower is likely to repay the loan.

Agreement

If the loan is approved, the lender and borrower enter into a formal agreement outlining the terms and conditions. This agreement specifies the loan amount, interest rate, repayment schedule, fees, and any penalties for late payments or default. The contract serves as a legally binding document, ensuring that both parties adhere to the agreed terms.

Disbursement

Once the agreement is finalized, the lender disburses the funds to the borrower. The disbursement method may vary depending on the type of loan. For personal loans, funds are usually transferred directly to the borrower’s bank account, while in the case of mortgages, the funds often go directly to the seller or the real estate agent.

Repayment

The borrower repays the loan in regular installments (monthly, bi-weekly, etc.) over the agreed period. These payments are composed of both the principal and interest. Timely repayments are essential to maintain a good credit score and avoid additional fees or penalties. Some loans offer options for early repayment, which can save on interest in the long run.

Interest and Fees

Interest is a critical component of a loan. It is the cost of borrowing money and is typically expressed as an annual percentage rate (APR). The interest rate can be fixed, remaining constant throughout the loan’s term, or variable, fluctuating based on market conditions. Apart from interest, loans may also include fees such as origination fees, late payment fees, or prepayment penalties, which can impact the total cost of the loan.

Benefits and Risks

Loans provide numerous benefits, such as enabling individuals to make significant purchases, invest in education, or manage emergency expenses without needing full funds upfront. For businesses, loans can provide capital for expansion, equipment purchase, or operational expenses. However, they also carry risks. Borrowers must ensure they can meet repayment obligations to avoid negative consequences like damaged credit scores, added fees, or loss of secured assets. Missed payments can lead to legal action from the lender and, in cases of secured loans, the loss of the collateral.

For a more detailed exploration of how loans can fit into personal financial planning, you may consider referring to guides by financial advisors or institutions, which are often available on their websites. Understanding the intrinsic aspects of loans helps in making informed financial decisions, ultimately contributing to better management of personal or business finances.

While loans offer opportunities for financial growth and management, potential borrowers should conduct thorough research, assess their financial health, and consider both current and future financial obligations before entering into any loan agreement. Planning and understanding the full scope of borrowing can significantly reduce the risks associated with loans.