FICO score

The FICO score is a measure of consumer credit risk and is today the most commonly used credit score to predict creditworthiness in the United States. The company behind it, FICO, was founded back in 1956 and is headquartered in San Jose, California.

The FICO score is a measure of consumer credit risk and is today the most commonly used credit score to predict creditworthiness in the United States. The company behind it, FICO, was founded back in 1956 and is headquartered in San Jose, California.

A lender (e.g. an issuer of credit cards or bank providing home mortgage loands) that is trying to determine the risk of giving credit to a certain individual can access that person’s FICO score, for a fee. In 2013, lenders paid to see over 10 billion FICO scores.

Basic info about the FICO score

The FICO score was introduced in 1989. It is based on consumer credit files derived from three large national credit bureaus:

- Experian

- Equifax

- TransUnion

The basic idea with a credit score is to use a person’s past actions in an effort to determine the likelihood of that person defaulting on loans in the future. The exact formula used to calculate a person’s FICO score is a secret kept by FICO, but the company has disclosed some information about their method.

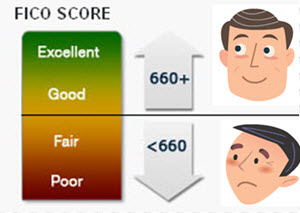

The higher your score, the higher your creditworthiness – at least according to FICO.

There are several types of FICO scores, including the classic or generic FICO score, the personal finance FICO score, the bankcard FICO score, the auto loan FICO score, the installment FICO score, the mortgage FICO score, and the NextGen Score.

The most generic or classic FICO score runs from 300 to 850, while other scores have other min and max levels. The FICO bankcard score and the FICO auto loan score does for instance start at 250 and go all the way up to 900, and the FICO NextGen goes from 150 to 950.

VERY IMPORTANT: A history of not paying on time or not paying at all

The single most important aspect when calculating someone’s FICO score is bad payment history, e.g. bankruptcy, liens, charge offs, repossessions, foreclosures, judgments, settlements, and late payments. A history of this type of financial problems can cause a FICO score to drop.

VERY IMPORTANT: Current debt burden

Another important aspect when calculating a person’s FICO score is debt burden. Is this person already in debt, and if so – what kind of debt and how much? Having debt doesn’t automatically mean that your FICO score will drop. You can for instance have a well maintained home mortgage loan and an excellent FICO score at the same time. One thing that FICO is known to be especially interested in is your credit card debt to limit ratio. Are your credit cards maxed out or nearly maxed out? Number of accounts with balances, amount owed across different type of accounts, and the amount paid down on installment loans are also examples of factors that can may impact your FICO score. Having one or more newly opened consumer finance credit accounts can be negative for your FICO score. Also, money owed because of a court judgment or tax lien are often extra damaging to a person’s FICO score, especially when recent.

Another important aspect when calculating a person’s FICO score is debt burden. Is this person already in debt, and if so – what kind of debt and how much? Having debt doesn’t automatically mean that your FICO score will drop. You can for instance have a well maintained home mortgage loan and an excellent FICO score at the same time. One thing that FICO is known to be especially interested in is your credit card debt to limit ratio. Are your credit cards maxed out or nearly maxed out? Number of accounts with balances, amount owed across different type of accounts, and the amount paid down on installment loans are also examples of factors that can may impact your FICO score. Having one or more newly opened consumer finance credit accounts can be negative for your FICO score. Also, money owed because of a court judgment or tax lien are often extra damaging to a person’s FICO score, especially when recent.

IMPORTANT: Length of credit history

A long history of responsible handling of credit will weigh more than a short history. FICO is likely to look at both the age of your oldest credit account and the average age of all your credit accounts.

This point is less important than the two points above.

LESS IMPORTANT: Types of credit used

It is good to have a history of responsible handling of several different types of credit. So, instead of just being able to show that you pay your home mortgage on time each month, you should ideally also have a history of responsible handling of other types of credit, e.g. credit card credit, consumer finance credit, revolving credit, etc. However, this point is even less important for your FICO score than the length of your credit history.

LESS IMPORTANT: Recent inquiries for credit

If you have made a lot of recent inquiries for credit, this can have a negative impact on your FICO score. However, there are many exceptions here.

- All credit inquiries are recorded and displayed on your credit report for two years, but after the first year they will typically not impact your FICO score at all.

- FICO is aware of the fact that consumers who are “rate shopping” and comparing different forms of available credit can rack up a lot of credit inquiries in a short period of time. You may for instance be trying to find the best possible offer for a credit card. This doesn’t make you a person with low creditworthiness – it just makes you a savy consumer. A large number of inquiries within a short period of time (2 weeks or 45 days, depending on the generation of FICO score used) will typically not have any major impact on a person’s FICO score since they will count as just one search.

- Inquiries pertaining to mortgage loans, auto loans or student loans do not count at all if they are less than 30 days old.

- Having pulled your own credit report / credit score for personal use will not count as an inquiry when your FICO score is calculated. The same is true for a credit report / credit score pulled by an employer or potential employer for employee verification, or by a company initiating a pre-screened offer of credit or insurance.

Does investments effect my credit score

Yes. Your investments might effect your credit score. There are a number of reasons for this. An important factor that influence your score is your debt burden. If you have invested in a lot of assets such as stock than these will help to reduce your relative debt burden. Another reason that your investments might effect your credit score is that dividends are seen as income and will help increase your credit score.

Only investments with a market value can help increase your credit score. This includes stocks and bonds. Investments such as binary options does not have market value and does not improve your credit score. If you do not already know what binary options are then you can find out more on this website.

Credit card debt to limit ratio – what’s that?

The credit card debt to limit ratio show how much of your available credit that you are using. It is also known as utilization ratio. You calculate it by taking the amount owed on a credit card and divide it by your credit limit for that credit card.

The credit card debt to limit ratio show how much of your available credit that you are using. It is also known as utilization ratio. You calculate it by taking the amount owed on a credit card and divide it by your credit limit for that credit card.

Example: You have a credit card with a $2,000 limit and you have a $500 balance on it. 500 / 2000 = 0.25. Your utilization ratio is 25%.

Since having a low utilization ratio can have a positive impact on your FICO score, it is sometimes a good idea to apply for a higher credit limit than you plan on using – provided of course that you can handle this in a responsible manner.

Example: Sarah has a credit card with a $2,000 limit and a $500 balance. Her utilization ratio is 25%. Jenny has a credit card with a $10,000 limit and a $500 balance. Her utilization ratio is 5%.

All other things alike, FICO will probably give Jenny a somewhat higher FICO score than Sarah, even though they both owe exactly the same amount ($500) on their respective credit card.

The history of FICO

- In 1956, an engineer named William Fair and a mathematician named Earl Isaac formed a company together and called it Fair, Isaac and Company. The two founders had met while working at the Stanford Research Institute.

- Fair, Isaac and Company created a credit scoring system and pitched it to lenders within the United States. Two years after forming the company, they got their first customer.

- 30 years after its foundation, the company went public on the New York Stock Exchange. It is traded as FICO.

- Fair, Isaac and Company launched their first general-purpose FICO score in 1989.

- In 1995, Fannie Mae and Freddie Mac started using FICO scores in their valuation of a potential borrower’s creditworthiness.

- The name of the company was changed from Fair, Isaac and Company to Fair Isaac Corporation in 2003. In 2009, the name was changed again, this time to FICO.

- Since 2013, FICO has been headquartered in San Jose, California.

Alternatives to the FICO score

The FICO score dominates the U.S. market, but there are alternatives. Here are a few examples:

- VantageScore

- C E Score

- Equifax Credit Score

- Credit Optics Score

- TransRisk New Account Score

- Experian National Equivalency Score